In sports, most people associate a team's financial success with its location: typically defined as either small-market or big-market. But the latest data from the 2008-2009 NBA seasons suggests that it is as much a combination of team success as it is market size.

The six teams with the highest percentage of seats at capacity represent a mixture of market size and team competitiveness:

Dallas Mavericks: 104.3% - mediocre season, strong market

Portland Trail Blazers: 102.6% - clinched playoff berth today

Boston Celtics: 100% - coming off 2007-2008 NBA Championship

Los Angeles Lakers: 100% - best record in the Western Conference

Phoenix Suns: 100% - competitive team but unlikely playoff berth

Utah Jazz: 100% - one of conference's best four teams

The worst performing teams are also the least attended (no shocker)... but it is not necessarily a function of geography:

Memphis Grizzlies: 69.9% capacity, down 1.6% from last year

Sacramento Kings: 71.3% capacity, down 12.4%

Minnesota Timberwolves: 73.7% capacity, 3 games above 80% capacity

Charlotte Bobcats: 74.1% capacity, down 2.9%

Philadelphia 76ers: 75.3% capacity; 2 games above 80% capacity

A few more ways to view this:

Three of the NBA's worst team, including the worst team at 16-59, are the least attended:

Sacramento Kings (16-59): 28 games under 75% capacity

Memphis Grizzlies (22-54): 26 games under 75%

Charlotte Bobcats (34-43): 22 games under 75%

The Washington Wizards are in the midst of a brutal season and have the second worst record in the NBA at 18-60. They represent the second biggest decrease in attendance (-9.2%). The Sacramento Kings are the only team with a worse record; they have a largest decrease in attendance at -12.4%.

Interestingly, Detroit is a bizarre case because they dominate in attendance despite having an off-year (currently in the 8th seed if the playoffs started today):

#1 in total attendance by 70,000 (786,591 through March 23)

#1 in average attendance per game at 21,850 (league average is 17,385)

I expected the lower trending for the under-25 crowd as that demographic grew up on Facebook and lives there. I would have expected that the 25-34 bracket would be Twitter's sweet spot - always online, early adopters and followers of pop-culture. But the 45-54 bracket is surprising... until you consider that marketers and companies indeed represent a significant portion of Twitter:

I expected the lower trending for the under-25 crowd as that demographic grew up on Facebook and lives there. I would have expected that the 25-34 bracket would be Twitter's sweet spot - always online, early adopters and followers of pop-culture. But the 45-54 bracket is surprising... until you consider that marketers and companies indeed represent a significant portion of Twitter:

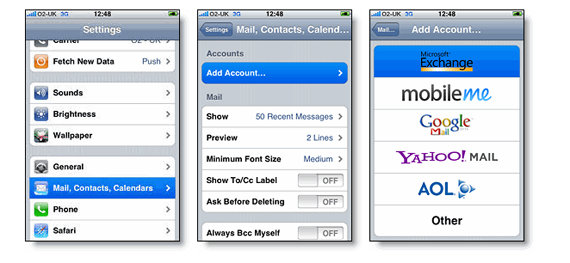

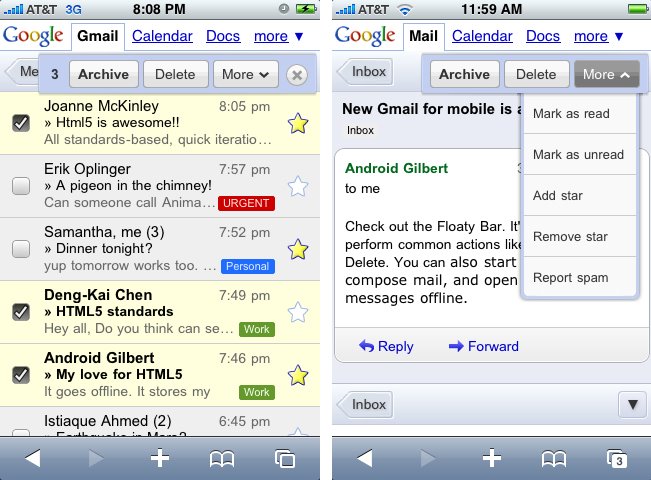

I'm left totally unsatisfied. I want a true application that works much like Gmail does between online and offline modes. Integrate my contacts and calendar... and I would never have to use my phone's core applications. It would include search, enable customizations and eventually allow for push notifications (when iPhone 3.0 arrives). I will continue being greedy and ask for integrations with Google Chat, Tasks, RSS and Maps. If monetization is the issue, I would have no problem with in-app ads (as Google does with the current Google App). Furthermore, I would imagine that monetization is more efficient in the app than on the mobile webpages.

I'm left totally unsatisfied. I want a true application that works much like Gmail does between online and offline modes. Integrate my contacts and calendar... and I would never have to use my phone's core applications. It would include search, enable customizations and eventually allow for push notifications (when iPhone 3.0 arrives). I will continue being greedy and ask for integrations with Google Chat, Tasks, RSS and Maps. If monetization is the issue, I would have no problem with in-app ads (as Google does with the current Google App). Furthermore, I would imagine that monetization is more efficient in the app than on the mobile webpages.